So you’ve cut your grocery bill in half, tried a spending freeze, and maybe you even have an emergency fund stashed away. Yet, every month, when those bills come due, they still feel like quite a bite. You aren’t alone.

Even though we’ve journeyed much closer to financial peace these days, and we largely have both our spending under control and our savings in a good place, I still cringe when those monthly bills come. During my most difficult times, I would simply not open them and just let them pile up, because I couldn’t face it. It isn’t easy.

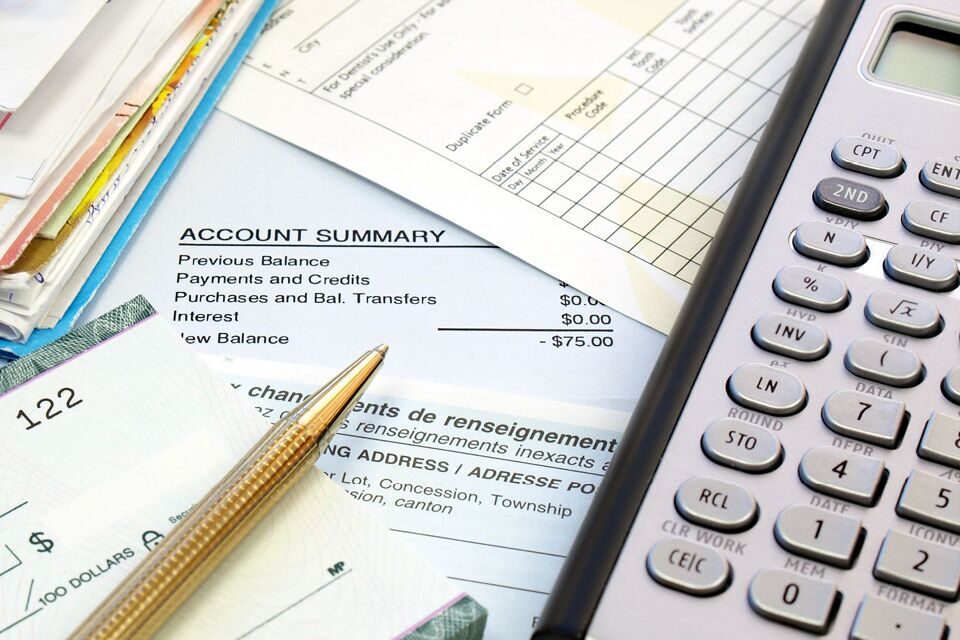

Bills can feel more manageable when you become budget savvy and sit down with a plan to get yourself on track. Part of the plan needs to include a careful review of each bill before you pay it. This includes medical bills, utilities, cable, phone and other services, as well as your credit card bills. You may be amazed at what you find in terms of billing errors and mistakes!

It’s pretty scary to think you might be paying extra for things you don’t even use or services you never received. Many common billing errors occur not because of malicious intent by the company, but due to simple human error and miscalculations. Even our trips to the store can include mischarges, sale prices that don’t ring up, and other extras we didn’t expect (or need) to pay for.

Doing your due diligence to review all charges is smart money management. It can help you save in the long run—and we all like to do more of that! Here are some common billing errors to watch for:

Medical Bills

Anyone who’s had a baby or spent time in the hospital for even a minor procedure knows how quickly those charges add up. There used to be a joke about $5 aspirin and $3 tissue charges on hospital bills. Even regular trips to the doctor’s office can seem shockingly priced.

Duplicate Services

One of the more common medical bill mistakes is for duplicate services. Each action a doctor, nurse, or assistant performs at the office has a code. Occasionally, a doctor will mark down a code and a nurse will charge for the same procedure using a different code. Many services are “bundled” now (as in tissues and aspirins are covered under one “hospital stay” code) but there’s still plenty of room for duplicate charges.

Ask for an itemized bill at the dentist, doctor and any time you have a medical procedure. When you receive your bill, scan it for anything performed once, but billed twice.

Charges for Extras

Similar to duplicate charges, extra items can appear on a medical bill as an oversight. I’ve found this to be particularly true at the dentist office, where the hygienist might suggest something to the dentist, who deems it unnecessary, but fails to take it off the computer…then, low and behold, it appears on your bill.

Always scan your bill to ensure you weren’t charged for something that didn’t end up happening—sutures when a butterfly bandage took care of the solution, extra pain medication not administered, etc. If you’ve had a hospital stay, it can be particularly confusing, with so many shifts and different technicians in and out. Carefully read everything listed to be certain you weren’t miss-billed.

Incorrect Diagnosis

Insurance companies and doctors commonly belong to networks, and they store diagnostic information and history in computerized systems. While this means your “chart” isn’t full of paper and clogging up important medical information sharing, it also means something like a misdiagnosis can follow you everywhere.

Not only does this affect your billing because you might be forced to opt for more costly treatments or medication, but it can also result in higher insurance premiums and coverage problems. It can even be life-threatening. For example, if you have an allergy to a particular medication and it’s not noted in your file, you could be provided or prescribed a drug that could cause a very adverse reaction. Alternatively, if you’re listed as having an allergy and it’s not really the case, you may have to opt for a more expensive alternative or you could be given a less effective treatment.

Doctors’ offices usually check any medical allergies and ask for updates on health changes, but if you aren’t asked, never assume it’s shared. Similarly, you can request a periodic review of your chart and diagnoses to ensure you aren’t listed as having a condition such as high blood pressure or elevated cholesterol, if it has resolved itself with diet or was a gestational issue.

In-Network Over-Charges

Another common billing error is when you’re charged beyond the cap set by your insurance company. When a doctor or hospital joins insurance “networks,” they agree to accept the reimbursement payment for procedures designated by the insurance company. They’re only allowed to charge you for your copay and for procedures not covered in your insurance plan. If they’re out-of-network, you may be charged up to the full amount (though most doctors will work with patients who are out-of-network or uninsured to find a scale they can afford).

Always compare your E.O.B. (Explanation of Benefits) from your insurance company with the bill from your doctor’s office to make sure you haven’t been charged above the agreed upon amount. If you have an annual deductable, the healthcare provider may charge you for the appointment, but they should still follow the cost outlined by your insurance provider.

“Rejection” Due to Error or Benefits Issues

Many medical claims get denied, simply because there’s an error on the form. Claims are submitted and reviewed, and something as simple as a missing digit in a social security number or an error in a diagnosis code can cause the claim to be rejected. If this happens to you, don’t panic. Healthcare provider staff members are highly trained to detect and resolve these issues.

Most of the time it’s as simple as resolving the error and resubmitting the claim. It can feel overwhelming and confusing because you may get a notice from both your insurance company saying the claim was rejected and a bill from your provider’s office. Always call to see if there was a billing error—perhaps the claim was submitted twice or there was a coding issue on a procedure.

Also, check with your provider and your insurance company before a procedure, if you can, to ensure it will be covered. Some insurers require a referral to specialists or a certain diagnosis to match a procedure or medication. For example, some antidepressants can also act as smoking cessation medication. Smoking cessation can be seen as “elective” diagnosis and may not be covered, but the same medication might be covered if depression is the primary diagnosis (rather than the secondary).

Phone Bills

We hear a lot about the great offers phone companies are running: special deals to customers who switch, special services, unlimited talk, text, data….and yet, when we get our phone bill each month, it never seems to be the price advertised. Here’s how to be smart about your phone bill and save big.

Cramming

Cramming is what happens when an outside company charges small fees through your phone bill. This might include items like text messages, games or ringtones you never agreed to or signed up for. According to the Federal Trade Commission, consumers should watch for things like, “Member Fee,” “Min Use,” or “Subscription” on their monthly statement.

If you think you’ve been a victim of cramming, contact your phone service provider and ask them to research the charge. You can also report the charges to the FTC (who’s actively cracking down on theses fraudulent scammers).

Data Use and Fees

While data usage, roaming and overage charges might not be “billing errors” per se, they can often be disputed, particularly if you didn’t know you were being charged and/or if it’s an uncommon situation for you. With the latest iPhone update, some users found a data “enhancement” was activated on their phone, resulting in extra data charges from their carriers. (Talk about an un-fun surprise on your phone bill!)

Always review your minute usage, your data and texting. If you’re coming in low each month, you may want to switch to a cheaper, pay-per-use plan (500 texts per month or a set amount of data). Some of us end up paying for data and usage we just don’t need.

Phone Insurance

Phone companies may talk you into an insurance/replacement plan if anything happens to your phone. Be sure to read the fine print before you sign up for these plans. They often include a monthly charge for the life of the phone and only cover it under certain circumstances.

Also check the phone manufacturer’s warranty to see if you’re already covered for damage. You may have paid for insurance when you purchased your device and you’re now paying a redundant charge for the same coverage.

Contract Charges

Paying less for your phone (or even getting a free phone) to be part of a two-year contract can seem like a great deal. However, once you’re locked into a contract, your rate will probably never go down. Instead, paying for the phone in a monthly installment plan and paying less for line access means you have the option of switching carriers, should a better deal come your way. It also means when your phone is paid off, you could see your monthly bill drop significantly.

A Note on Small Carriers

Going for a big provider (T-Mobile, Verizon, AT&T, Sprint) can seem frustrating. Maybe you won’t get the individualized service you like or maybe you aren’t thrilled to be supporting the “big guys.”

Unfortunately, supporting the big guys means you’ll often get better deals on your service. You can always call and renegotiate for the latest deal or ask them how you can lower your monthly payments. It also means you’ll get much better coverage and you won’t risk paying roaming or data-access fees.

Cable & Internet Bills

We’ve discussed the many ways you can lower your cable bill and it’s true—by cutting out cable or cutting back, you can save significantly. However, there are still some billing errors you should watch for on your cable and ISP bills, so you can help ensure you’re maximizing your savings.

Annual Deals

Most cable and ISP companies run annual deals like, “$29.99 for high speed data for ONE YEAR.” Well, after a year passes, how many of us forget to check our bill to see what happened when the deal ran out? Unfortunately, cable and ISPs bank on this forgetfulness. Suddenly, several months have passed and you’ve paid $50+ per month for the same service.

If you signed up for your current service on an annual deal, check your bill to see if you’re still receiving the same rate. If you find your bill has increased, call the provider to see if they can lower your rate (most of the time they can). If they say no, it’s probably time to switch.

Bundling

If you bundled services to save money, keep an eye out for continued savings on your monthly bill as well. Bundled services can suddenly be listed individually and you won’t be saving nearly as much as you were when you signed up.

This is again, time to call your provider and point out the increased fee to see what they can do to get things moving in a downward direction. After all, if you kept a service, such as a landline, simply because it was a better deal to “bundle,” you don’t want to pay extra for the service once the deal has run out.

Service Fees

If you’ve switched services or changed to a different speed, you could be looking at a whole new slew of service fees. There’s an installation fee, a technician fee, an annual service charge—the list goes on. Put your foot down on these fees right from the get-go by letting the provider know you’d like to switch or upgrade only if they will wave the installation fees.

Generally speaking, tax and some regulatory fees will appear on your Internet and cable bill, but they should be nominal. With the market as competitive as it is these days, ISP and cable companies are usually willing to waive fees to keep customers.

“Rental” Agreements

A modem rental fee can add up ridiculously fast. Most are $8-10 per month, yet you can purchase a modem for about $50. (But first, be sure to do some research to learn which types of modems your ISP supports.) Paying a modem rental fee isn’t necessarily a billing “error,” but it’s definitely a commonplace item on your bill, so figuring out ways to take it off will certainly save you money.

If you aren’t so tech savvy and you don’t want to be responsible for purchasing your own modem, call your ISP to see if they can do anything to minimize the rental fee—or see if you can upgrade to a faster modem for the same rate. Modems last a few years, so if yours is past its prime, there’s no reason you should continue to be unhappy with it while paying a monthly rental fee.

Utility Bills

There are many smart ways to save on utilities, from turning your use down and being more energy aware and efficient to regular maintenance. Most of us aren’t ready to live off the grid and give up electricity and access to water, so these bills are just part of life. We put them on our automatic pay pile and sort of forget that errors can show up. It’s time to revisit those utility bills!

Overlapping Charges

Just like other bills, utilities are subject to human error. One of the most common errors is overlapping charges from one month to the next. Make sure the date range reflected on your bill coincides with the range on the previous invoice.

Similarly, make sure your invoice reflects your last payment and it was processed and credited correctly. Late fees and other charges can inadvertently occur and if they’re small, they can be overlooked.

Charges from a Previous Owner

If you’ve recently moved, be absolutely sure you’re only paying for charges you accrued. Something as minor as a one-off digit in an address or a missing middle initial can mean you’re getting charged for someone else’s utility usage.

If you rent, this is especially an issue. Billing should always be linked to the person, not the residence. You don’t want to have your credit damaged or pay extra because a previous resident didn’t pay their bill on time. Call the utility company to work it out with them directly, rather than expecting your landlord to make the call. While it’s in their best interest to keep the water running and heat working, they won’t be as diligent about saving you money.

Miscalculations and Misreads

Keep your calculator handy and keep an eye on your previous meter reading. If it’s winter and you just turned on your furnace, or summer and your air conditioning’s running and kids are using more electronics while they’re off school—you can expect to see an increase. If it seems extreme or if it jumps in an unusual way from one month to the next, take a closer look.

Keep your calculator on hand so you can make sure your calculations match the billing (even computers can make errors and rates can be keyed in with an extra zero). If you notice anything that doesn’t make sense, contact the company and ask them to investigate. Similarly, if you’re wondering about a powerline that seems to run from your neighbor’s house or if you see a lot of usage during times you’re away, don’t be afraid to ask. You may be paying for a crossed line or someone else’s power!

Budget Billing that’s Not Rolled Forward

Budget billing makes paying utilities much easier. You’re facing a set amount each month and it’s recalculated annually or bi-annually based on your usage. If you’re up for a recalculation, always check the math to ensure it’s correct and that the right amount is rolled over and applied. So often we trust anything printed on paper must be correct, so we don’t even look unless it’s very unusual.

Your budget-billing rate sets your utility costs for the whole year. So $5 or $10 per month may not seem like a big deal, but it can add up quickly.

Credit Card Bills

Credit cards aren’t “bad,” per se. Of course, we all know they can quickly send our credit and spending spiraling out of control. However, they can also be tools to help us save, gain mileage, and protect us from having our checking account drained in the event of credit theft. We’ve talked before about ways to avoid common credit traps and the best ways to save on your credit bills. There are also a few common billing errors to watch out for.

Unauthorized Charges

This is the biggie. Always carefully check your credit card statement for unauthorized purchases, charges you don’t remember making, and other signs of fraud. Some thieves and scammers use very small amounts so their fraud isn’t readily detected or it’s easily overlooked. Months can go by before you realize you’ve been paying a monthly charge to someone you didn’t authorize.

If you notice anything unusual, don’t hesitate to call your credit card company. Many companies can change your card number and get you a new card in a matter of a day or two. It’s always worth reporting fraud to prevent it from escalating.

Annual & Late Fees

While they may not exactly be “errors,” these extra charges can appear on your bill without warning and should always be addressed. If you’ve received a late fee and your payment was under 30 days behind schedule, most companies will be willing to reverse it. There are times when it literally crosses in the mail, so perhaps the company received your payment just a day or two late.

Similarly, always call to see if you can have your annual fee waived or if you can switch to a card offering no annual fee. While not every card offers this, the market is competitive and most companies strive to keep your business.

Interest Rates

Another thing to watch on your credit card statement is an increase in interest rates. Many credit card companies offer no interest for 6 months or one year, or a very low introductory rate. When the rate runs out, you may see a sudden jump on your credit card statement.

Call your credit card company to see if you can lower your interest rate. If they’re unable to do so, talk to your bank or credit union to see if they can assist you with a lower-interest loan or line of credit to consolidate and pay off your balance.

Other Billing Errors

Billing errors can occur in many other places as well. Any time someone sends you a bill for a service, repair or purchase, carefully read and review the paperwork you’re given. The best time to address a discrepancy or suspected billing error is right away.

Areas to keep a close eye on are:

- Hourly rates

- Service fees

- Interest rates and late charges

- Misapplied payments

- Mismarked sale items

- Unapplied coupons

- Prices not as marked

Typically, by the time we get to the checkout counter, or we’re ready to pick up our car, or we’re paying the repairman or hairstylist, we’re focused on getting out the door. This is one of the most common times for errors to occur. We’re in a rush and we don’t feel it’s a comfortable time to ask about a charge. Or we simply don’t remember what price was marked or what we agreed to pay in the first place.

For these moments, I recommend keeping a little notebook, calculator or even jotting down a note in your phone. While saving ten cents on bananas at the grocery story isn’t going to make a world of difference, we all know every little thing adds up.

Carefully check your receipt after a transaction, and don’t be afraid to go to the service counter and point out a discrepancy. Watch the price of items as they’re scanned in and mention to the cashier anything that doesn’t seem right. Check to see your coupons are applied and never be afraid to return something if you get home and it’s broken or defective.

We’re all human and bound to make mistakes. Just make sure other people’s mistakes aren’t costing you extra on your bills!

P.S. The new Living Well Planner has a BETTER BUDGETING section. We’ve made our budgeting pages even more intuitive and user-friendly. Check it out HERE.

P.S. The new Living Well Planner has a BETTER BUDGETING section. We’ve made our budgeting pages even more intuitive and user-friendly. Check it out HERE.

TAKE BACK CONTROL OF YOUR HOME LIFE

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

If you love this resource, be sure to check out our digital library of helpful tools and resources for cleaning faster, taking control of your budget, organizing your schedule, and getting food on the table easier than ever before.

ALWAYS request itemized hospital bills. I had rapid deliveries with both of my babies and was billed for services I didn’t receive. With the first, I was billed for an epidural and IVs that I didn’t have time to receive. With the second, I barely made it to the delivery room. One doctor basically ran in to “catch” my son and then my actual doctor showed up to finish everything up. When I got the bill, I was billed for 2 full physician deliveries. I had to call and insist that the doctors either split the delivery fee between them or code it to one or the other.

This happened to me! I was scheduled to get x-rays at my dental checkup but when I told them I was pregnant they didn’t do them. Still showed up in the bill. It was a big hassle and all they would do was credit it to my account-basically I had to come back to get the X-rays the next year to use the credit. Taught me to always check the bill!

We are dealing with this right now. Our dentist keeps billing us for a service that is covered by insurance and insurance keeps saying they never got the bill. Its so frustrating but I refuse to pay even $1 more than I have to!

My dentist has a billing problem too- my husband gets billed “code 0552” and it costs $45, I get billed “code 0522” and it costs $55. I only caught it when we had our appointments on the same day and our bill showed both charges side by side. Turns out it’s been billed like this for years!!