Let’s face it—being a responsible adult is not always easy. In fact, the idea of saving money can feel painful sometimes! Few of us actually want to give up our creature comforts or drastically lower our standard of living in order to pinch pennies. It’s downright hard to have to tell a child or spouse that something is out of the budget this month, and it’s not always fun to make sacrifices with the big picture in mind.

And while meeting those big financial goals like building an emergency fund or paying off debt WILL probably take some serious effort on your part, the good news is that there are also ways to save money without having to make big sacrifices.

Believe it or not, saving money can, in some cases, be painless, fun—and even addicting (in a good way)! In fact, some companies, like brightpeak financial, will even reward you for learning to make saving a habit! Download this free “10 Simple Ways to Boost Your Emergency Fund” eBook for more information on how you can earn $100 just for saving $1000!

By making it a game and getting the entire family on board, you’ll find that a little savings here and there will really start to add up. Check out these great little ways to painlessly save!

1. Cut Your Cable

Most of us enjoy watching at least a few shows each week to relax and unwind, but what if you could access most of the shows you love for a whole lot less? Cable is FULL of hidden fees, plus it seems we’re always dealing with random price increases or channel packaging changes.

If your cable bill is running you over $20/month, you’re paying too much. Surprised? Netflix is just $7.99 per month after a free month (no hidden fees) and Hulu (which offers more current television shows) is also only $7.99 a month after a free week. We love our Roku box! It offers 2,000+ streaming channels, so you can mix and match the (much cheaper) services that best fit your family’s television habits and budget.

An added bonus of cutting out regular TV in favor of streaming? No commercials! Believe it or not, cutting out commercials is a great way to save, and an amazing way to keep your kids from becoming enamored with everything they see on TV!

2. Access Free Learning Resources

If school isn’t a walk in the park for your kids, there are plenty of online resources that are much cheaper than a tutor. ClassZone offers lots of educational resources that build onto their textbook curriculum, but also offers a ton of additional, standalone help your middle school and high school students can access for free.

There are also plenty of online learning resources for adults. Try MIT OpenCourseWare to learn about everything from aeronautics to media arts. You really can’t beat this top-notch completely free resource for lifelong learners.

For both kids and adults, learning to code can be a hugely advantageous skill in today’s job market. Codecademy courses are a super fun, interactive learning experience—and again, all completely free.

3. Read for Free

Another great resource for learners? Your local library. Your local library offers books, movies and music—and many now grant you access to Zinio for FREE! All you have to do is walk in, get a library card, and start exploring the world at your fingertips.

If you love books but have a hard time finding the time to read, you may also want to check out Audible. Your first 30 days (and your first book) are completely free, so there’s no risk. You may find you’re spending less money on books while enjoying them even more. The cool thing about Audible is that you can request to put your account on hold when you get behind on your reading, so you’re never wasting money. You can also check out Google Books for thousands and thousands of books online, available on nearly any device—all for free.

One other great way to save on books? Sign up to be a book reviewer through a program such as Book Look Bloggers, which sends free books to bloggers for review. Don’t have a blog? You can set one up in less than ten minutes HERE.

4. Switch to a Bank that Pays

As mentioned above, brightpeak financial, which offers a variety of financial planning services for families, offers a savings rewards program that will pay you $100 once you hit $1000. Download their free “10 Simple Ways to Build an Emergency Fund” eBook to learn more. Another option to consider is PNC Bank, which has 3 different cash back options, ranging from $75-$300.

Online banks can offer some unique savings, since a lower number of brick & mortar locations allows them to pass their own savings on to you in the form of better interest rates and cash bonuses. Capital One 360 also has several cash back options, including one for kids.

5. Save While You Spend

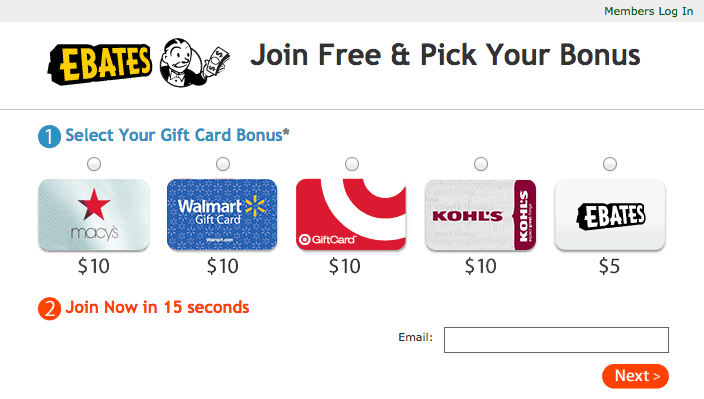

There are lots of really great ways to save while you spend, and most require very little extra effort. Just be careful that you don’t use this as an excuse to buy more! Buy only what you will use and stick to the items on your list. Some may still find it easier to shop with cash, but if you do shop online, you are doing yourself a disservice NOT to utilize easy to use program such as Ebates or Inbox Dollars, both of which give you cash back on the purchases you make. Both programs also have great incentives for joining–Ebates gives you a $10 gift card to the store of your choice, while Inbox Dollars gives you $5 cash. I recommend signing up for both, then deciding for yourself which one is more convenient to use, and which one works with the stores you shop at most regularly.

Another painless way to save while you spend? Round up and save your change. You can start as small as you like. Make a pact with yourself to throw your extra change in a jar whenever you return home with less than $2. If you bank at Bank of America, sign up for their Keep the Change program and your spare change will be automatically transferred to your savings account.

6. Take Advantage of Special Discounts

Are you a student, senior citizen, a teacher, or in the military? Always, always ask for the appropriate discount. Sometimes stores and entertainment facilities offer these discounts but do not post them or actively advertise them. Be brave. It doesn’t hurt to ask!

Discounts for teachers are more widely available than you may think. For example, Jo-Ann Fabrics offers a Teacher Rewards Discount Card, Michael’s offers teachers a 15% discount on all purchases, the Barnes & Noble Educator Program offers a number of teacher discounts and rewards, and even Sprint offers a ton of teacher discounts. Again, always ask!

Check with your employer to see if you’re qualified for savings on anything from your phone bill to your business attire. Target, Men’s Warehouse, Avis, J. Crew, Shoes.com, Restaurants.com and many, many more retailers offer discounts for employees of their hundreds to thousands of corporate partners.

7. Try Easy Freezer Cooking

My husband and I have always loved eating out, and it was often our go-to option anytime life got busy or we weren’t prepared for dinner. Over time, it became an expensive habit! The idea of freezer cooking was always overwhelming to me until I discovered “cheater” freezer cooking–simple recipes that don’t require pre-cooking, and take just minutes to throw together. Now I can whip up ten budget friendly meals in about an hour, which means that we always have easy, delicious meals ready to go.

It has been a lifesaver!

If you haven’t yet tried any of our simple freezer recipes, or followed one of our 10 Meals in an Hour Plans, you are seriously missing out! Start by reading these 7 tips for freezer cooking like a pro, then set aside a Saturday morning to give it a try. I promise you won’t regret it!

8. Hire a Bill Negotiating Service

Sometimes reducing your bills it is just a matter of thinking outside the box, and knowing what resources are available to help you save without even trying. One really great option is to look at a service such as BillCutterz. This innovative service helps negotiate better rates for all your bills, and then splits the difference with you. While you still have to pay them for the service, you will still be paying less over all. They only get paid if they are saving you money, which means that it is not only painless, but a no-brainer! You can find out more HERE.

9. Make Your Home a Sanctuary

There are lots of ways you can decorate on a budget, or even smart ways you can revamp your space for free. A fresh coat of paint can completely transform a room–and your attitude. In fact, just taking the time to clear the clutter or deep clean your house from top to bottom can make all the difference in the world.

When you love your living space, you want to stay home more. You are more likely to invite others over, and less likely to go out and spend mindlessly. My good friend Edie from Life in Grace has some great thoughts about staying at home that are definitely worth a read. The next time you are tempted to just get out of the house, ask yourself whether you are simply trying to avoid a mess or unwelcoming space.

10. Exercise at Home

And speaking of staying home, consider kicking your gym membership too. Pricey memberships can add up to thousands each year and sometimes they go unused or barely used. If the weather is great in your area—simply go outside! Or, consider workouts you can do at home or through your local community recreation center. If you need to get out of the house to work out, check if your local high school offers pool access off-hours or if your local mall is open to walkers in the mornings. Try workouts on YouTube or grab a DVD rental from the library to mix it up. A family walk or bike ride costs nothing and gets everyone’s heart pumping and healthy.

* * *

Meeting your financial goals does take effort, but not every attempt at saving money has to hit you where it hurts. Try these little ways to painlessly save. You might be surprised how easy making little tweaks in your daily routine can be—and how quickly the savings add up! Believe it or not, saving money really can be a fun family challenge. Viewing each experience as an opportunity to enrich your learning, increase family togetherness, and learn new skills can make it feel like more of an exciting journey and growth experience (instead of a sacrifice and a chore).

You may find that with a little effort in painless saving, your entire family will start on their path to becoming super-savers—and actually enjoy the process!

TAKE BACK CONTROL OF YOUR HOME LIFE

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

If you love this resource, be sure to check out our digital library of helpful tools and resources for cleaning faster, taking control of your budget, organizing your schedule, and getting food on the table easier than ever before.

I was buying way too many clothes. My tip is to choose one more expensive high quality item per month instead of buying 10 poor quality, cheap items that will be in a Goodwill bag 2 months from now.

Now this doesn’t work yet for my kids as they still grow out of things every 3-12 months.

I’ve heard of some of these, but not others. I’m definitely looking in the reading for free options.

Also remember to ask for AAA discounts too!!

I tried going without satellite, but we are too far out to get good reception. I’d get Netflix or Hulu, but we also can’t get high-speed internet. Streaming entertainment on Verizon cellular Mi-Fi is EXPENSIVE. I’m already on it non-stop for job hunting, socializing, blogging, etc. It’s our most expensive utility.