Part 8: Make More Money

Here’s the good news: you’ve made it to the end. It’s week eight and you have arrived, you’ve followed through, you’ve worked hard and made huge strides. You truly deserve a pat on the back. Way to go, you!

(NOTE: If you are new to LWLS or missed out on the last seven weeks, you might want to start at Week 1: Stop Spending before reading any further!)

So here’s the bad news, at least for some of you: After delving into your finances and taking a long hard look at what you are earning versus how much you want or need to spend, you have realized there is a serious problem. You are either spending more than you are making, are drowning in credit card debt, or perhaps just squeaking by with nothing left over for holidays or vacations or retirement. You’ve cut your expenses every place you can, but it’s still not enough.

It’s time to make more money.

It’s time to make more money.

(This is probably the point at which, if you happen to be drinking milk, it would shoot out of your nose.)

Okay, Ruth, you’re thinking, sure, I’ll make more money. I don’t know why on earth I didn’t think of it before. [insert heavy sarcasm] Clearly my budgeting problems are all in my head. I just need to turn the money faucets on a little higher.

The really bad news is that in fact there is no magic money faucet. If there was you certainly wouldn’t be reading this blog!

However, there is some good news too! Even in a slow economy there are still plenty of opportunities for supplementing your income, many of which can be done from home. Perhaps none of them will make you a millionaire (though some might) but a few extra bucks here and there can definitely start to add up quickly.

The important thing to realize is that taking the first step towards doing something is the hardest part. Filling out that job application, signing up online, taking the initiative to set up your own Etsy shop, or even creating a resume after being out of the workforce for a while and having no idea where to start.

Change is scary, but sometimes necessary. If you have found yourself in a position where you have honestly cut your spending every place you can and you’re still not making ends meet, then it is time to take a deep breath, face your fears, and get yourself a job.

{This final assignment can apply to you even if your situation is not dire. Perhaps you’d just like to have a little extra spending cash or rainy day fund put more away for your children’s college tuition. Anyone can benefit from earning more money.}

This week’s assignment:

1. Assess your skills.

What are you good at? What do you like to do? What can you do? Are you great with kids? A super speedy typist? An excellent writer? Handy on the computer? Maybe you’re good at fixing things or a talented seamstress, or an artisan in some other way. Have you ever done bookkeeping? Do you like cleaning? Love clothes? Want to work with people?

Take a moment to write down all the skills you’ve used over the past 5 years in both the professional and personal arena. It should be a LONG list–everyone’s got skills in some area. Not all of them must be things you’re the BEST at, just things you are competent at.

2. Begin looking for opportunities

Take the list you just made and circle ten things that you LIKE doing, and then think of one way you could turn each skill into a money making opportunity. It doesn’t have to be totally realistic just yet; this is just an exercise to get your brain moving in an entrepreneurial direction. For example, if you like baking, you could put “sell baked goods” or if you love mowing the lawn, you could put “lawn service.”

When you’re finished, you’ll have a list of 10 things to start with. It’s time to start looking.

Cruise the local classified ads or check out all the job opportunities on Craigslist, or, if working for “the man” is not your thing, decide which of the items on your list would be a feasible small business idea, and then jot down some steps you would have to take to make it happen.

If you’re completely stumped, here is, off the top of my head, a list of home based businesses you could start right away, or you can check out these 15 Smart Ways to Earn Money at Home:

- In-home babysitting (trust me, people ALWAYS need babysitters!)

- House cleaning

- Home-cooked meal delivery service

- Lawn-mowing or weeding services

- Gardening services

- Handyman services

- Errand service (Running the errands that others don’t have time for)

- Bookkeeping services

- Personal or virtual assistant

- After-school tutor

- Multi-Level Marketing (such as selling Essential Oils)

- Opening an Etsy shop to sell handcrafted or vintage items

3. Make money in your downtime

There are lots of ways to earn a little extra cash or gift cards by doing things you already do:

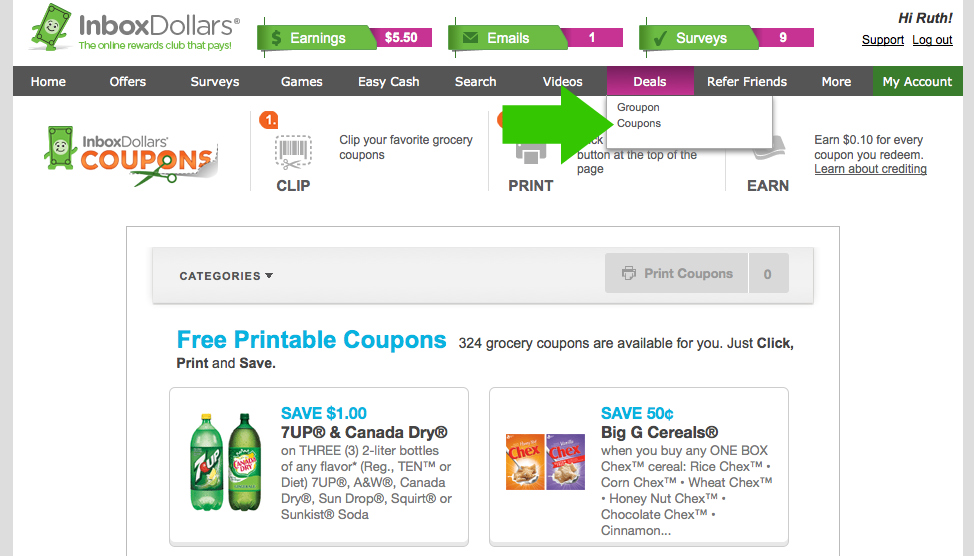

- Inbox Dollars–Earn cash for shopping, clipping coupons, & taking surveys.

- Ebates-If you EVER shop online, go through Ebates to find the store and earn cash back on your purchase!

- Secret Shopping-If you love to shop, why not get paid for it?

4. Get some more advice

Not quite ready to take the plunge? Check out some of these awesome ideas for earning extra cash:

15 Smart Ways to Earn Money at Home

5. Just do it!

Change is always scary, and the thought of making money from a home based business can sound overwhelming. Don’t let it be. Take it one step at a time and just do it. Take the leap of faith. Take the pressure off yourself by realizing that any extra income is better than none. If you let your fear stop you from making a change or following your dreams, you’ll never get anywhere. And what fun is that?

One of my favorite quotes is from Eleanor Roosevelt:

You gain strength, courage, and confidence by every experience in which you really stop to look fear in the face. You must do the thing which you think you cannot do.”

And now **sniff sniff** we’ve come to the end of the LWSL Beginner’s Guide to Savings series. If you made it this far, congratulations. I hope you’ve learned something along the way–I know I have!.

As always, I love to hear from you. Please let me know your final thoughts on this series, and what, if anything you feel you’ve learned along the way. What do you feel was most helpful? What would you like to see more of in the future?

* * *

The LWSL Beginner’s Guide to Savings

Week 3: Save on the Big Things

Week 4: Save on the Necessary Things

Week 5: Save on the Fun Things

Week 6: Save on the Special Things

TAKE BACK CONTROL OF YOUR HOME LIFE

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

If you love this resource, be sure to check out our digital library of helpful tools and resources for cleaning faster, taking control of your budget, organizing your schedule, and getting food on the table easier than ever before.

Thanks so much I am trying to get out of debt and put away money and use coupons for menus and groceries and this hit the spot on every one of these. Thanks so much. I reccommend this to everyone.

I’m go smacked there aren’t more comments! Thank you for these tips I’m in that exact position… Wanting more money than month . You have inspired me once again!!!!! Thank you

I’ve been reading your site for a few months now & I really love it! You seem really down-to-earth and I love your videos (I know you said you won’t be doing them weekly, but I’m still hoping you’ll change your mind LOL) I wish my grocery stores had BOGO everything practically every week of the year, but even without that you help me save $$ every week! Keep up the great work! 🙂

Thanks for this! I’ve been looking for ways to make extra cash to help me pay down my debt faster.