Have you ever wondered why some families constantly struggle to make ends meet, while others magically have all their finances together? Is it the way they were raised? Is it simply in how they do things?

Although these questions don’t always lend themselves to an easy answer, I honestly think it starts with the difference in our habits – both in what we’ve learned as young children, and how society impacts our current environment.

For me personally, I was taught at an early age to save my allowance, watch my spending, and make carefully calculated decisions to reach my dreams and goals. While some of that has to do with my overly-analytical personality, I am incredibly thankful that my parents taught me how to be smart with money, and instill in me the financial habits that make up so much of who I am today.

But as the saying goes, more is caught than taught, which means absolutely anyone can adopt these same budget-savvy habits that are so critical to financial success. Although it’s not a magic formula that will change your current situation immediately, continued persistence and hard work will eventually pay off.

You’ll already be way ahead of the game that so many refuse to play, and ready to make a lifelong change that matters!

1. Control Your Spending

One of the first ways to turn your relationship with money around, is to watch what you’re spending on a day-to-day basis. Are you a shopaholic? An impulse buyer? A scouter of good deals that you just can’t pass up?

It can be really painful to pull out all those receipts you’d rather stuff in the trash, but realizing that your expenses are out of control is the very first step. Once you’ve owned that you have a problem, make a commitment to stop spending completely, then track every single purchase from now on.

When you develop the habit of knowing exactly where your money is going, you can put an immediate stop to money leaks, and stay out of the stores (or online websites!) that tempts you to pull out your wallet.

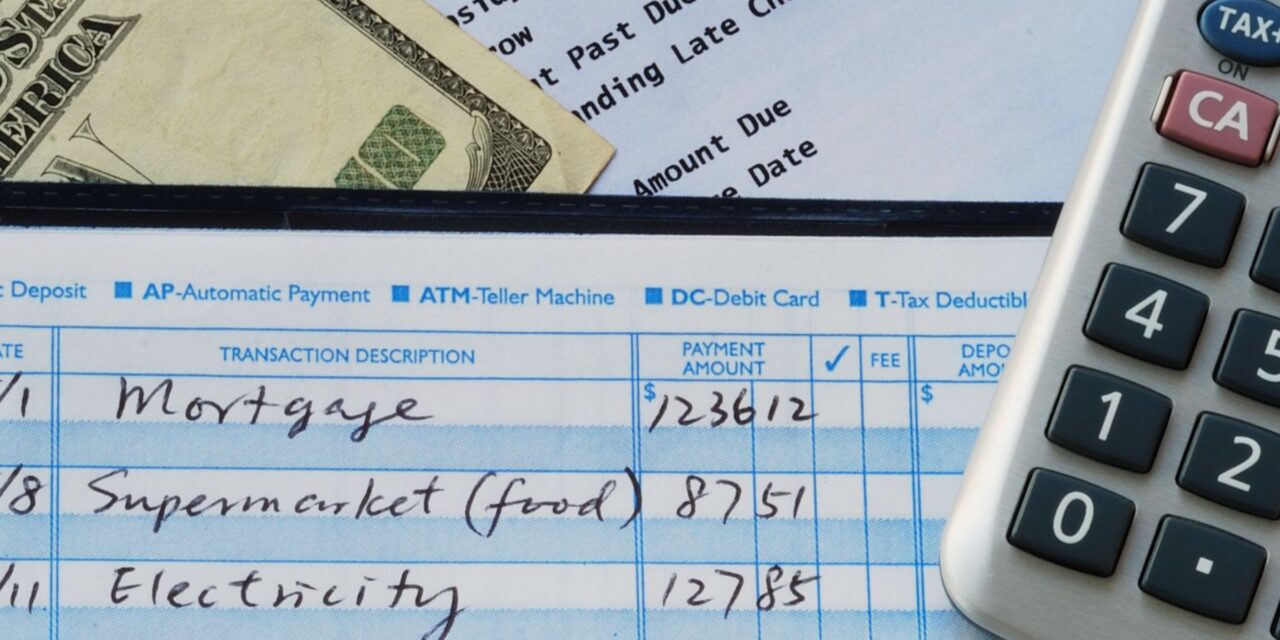

2. Maintain a Budget

Whenever I think of someone I admire, particularly in the way they handle their money, they almost always have a budget or spending plan in place. If you think a budget sounds restricting and boring, nothing could be further from the truth! In reality, a budget is actually motivating, freeing, and will help you reach future financial goals.

Before deciding how you will budget, remember that not any one software or system will fit everyone. Take whichever plan you want to try and tweak it to fit your family. And don’t give up if it doesn’t work right away. Test the vast market of free budgeting apps available, make your own Excel spreadsheets, or look into Dave Ramsey’s Financial Peace University. I even have a Beginner’s Guide to Budgeting series on Creative Savings, which will help you create a simple budget from start to finish.

It’s also important to create a separate savings account, and especially to create an emergency fund of at least $1,000 to be prepared for the unexpected. Some companies, like brightpeak financial, will even reward you for learning to make a habit of saving!

When you develop the habit of making a plan for each paycheck, you take control of your money instead of letting it control you.

3. Create Accountability

It’s never fun to make yourself accountable to someone. Just the thought of letting someone into my finances is enough to make me squeamish. I don’t want anyone to see where I’m spending, and then judge me for it!

But it’s not about judgement – it’s about giving permission to someone you trust completely, and allowing them to help guide you on the path to financial change. It can be a caring husband who gently takes your credit card away, or a wise friend who suggests you plan a walk in the park instead of your usual $20 lunch meet.

Accountability also takes form in the checkpoints you set up for yourself at home. By converting to an all cash system, you know exactly what you are allowed to spend, and when it’s gone, it’s gone. If you’re hesitant to use cash, keep yourself accountable in a specific area of your budget by keeping a small tally sheet nearby to make sure you don’t go over budget.

And lastly, use post-it notes! I not only love to use post-its as my daily to-do lists, I also put them in my wallet or on the fridge to remind me of a goal I’m saving toward. Accountability is a must if you want to develop the habit of consistency and continued progress.

4. Set Financial Goals

4. Set Financial Goals

Speaking of financial goals, if you don’t have any right now, take some time with your spouse {or a friend if you’re single}, and write down some of the things you’d like to accomplish in the next 2-5 years. Think of it as a bucket list for your budget, and be sure to write down the date you’d like to reach each goal beside every item on your list.

Whether it’s paying off debt, saving for a much-needed home renovation, or starting an emergency fund, as long as it has to do with your money, make it a financial goal. However, it’s not enough to simply write down these goals, as tracking them continuously will keep you from getting discouraged and help you see monthly progress.

Remember, if you don’t know where you’re going, then you can’t plan to get there. Develop the habit of goal setting and finally turn your dreams into reality.

5. Reward Yourself

Giving yourself a treat or a reward may not seem like it fits with this whole “developing good habits” kind of thing, but I’ve found that I’m even more discouraged if I don’t at least indulge a little after reaching my goals.

However, this doesn’t mean I go on a spending spree without a care in the world for the hard work I’ve put in the last few months. Instead, I build in a reward category right into my budget to fund these incentives. Done sparingly, these $15-$20 splurges can actually encourage you to keep going, and help you tackle yet another goal on your list. Just don’t get too crazy, and learn to develop the habit of restraint and grace!

While these 5 habits might sound really hard to start, let alone maintain, they will soon become second nature the more you practice. There’s no such thing as failure – just learning – so let that fuel your resolve to try your very best.

Pretty soon you’ll be able to pass on these budget savvy habits to your children, and show the next generation that we too can be responsible with our money and change our future.

TAKE BACK CONTROL OF YOUR HOME LIFE

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

If you love this resource, be sure to check out our digital library of helpful tools and resources for cleaning faster, taking control of your budget, organizing your schedule, and getting food on the table easier than ever before.

4. Set Financial Goals

4. Set Financial Goals

The cheat sheet link takes me to an expired offer page: https://ruthsoukup.lpages.co/lwsl-offer-expired/