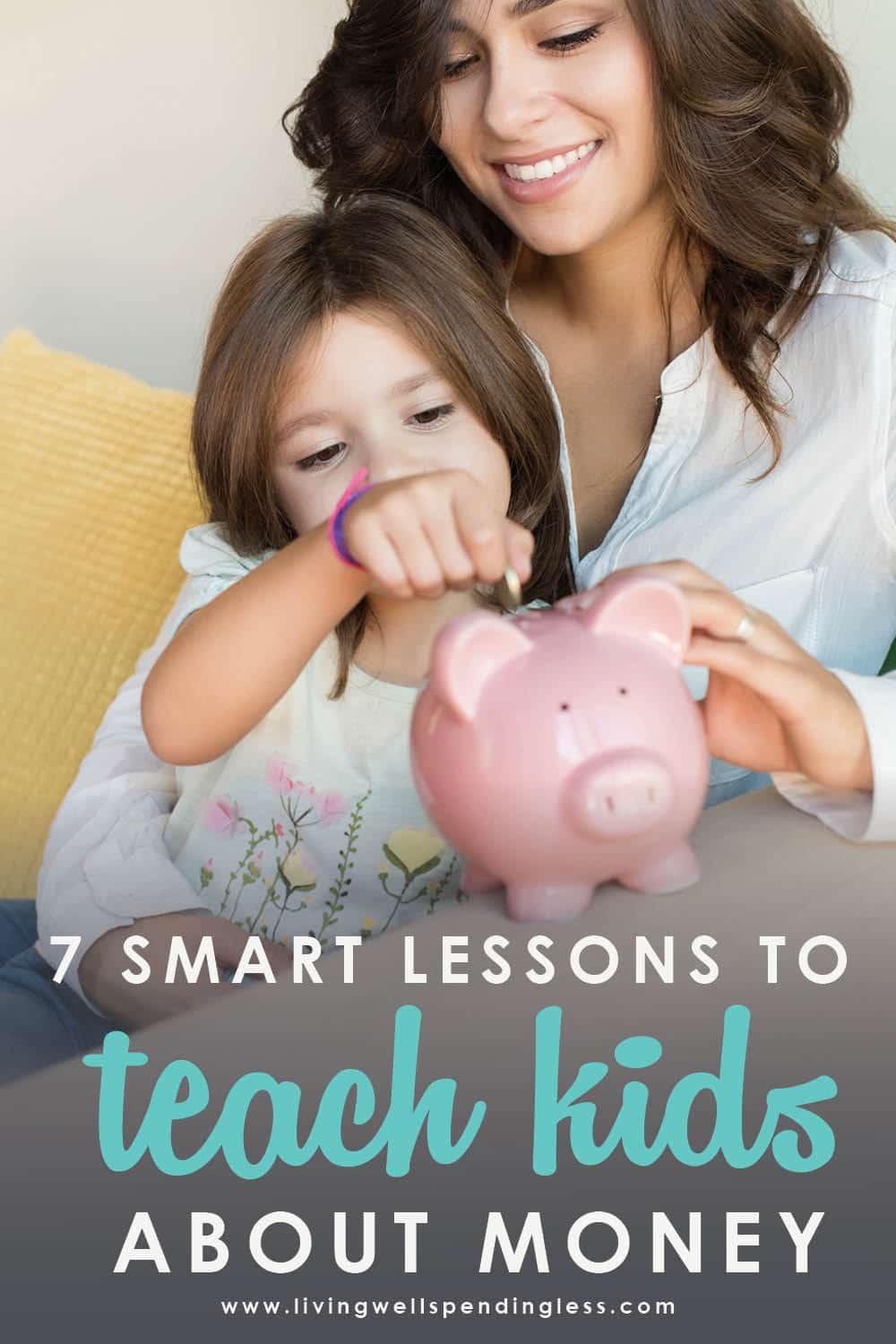

Wondering how to teach kids about money? These 7 smart tips will help your kids form healthy financial habits and learn to save.

Growing up in my family, the first rule of money was this: We don’t talk about money. All I ever knew is that we had more than enough. While my parents did encourage me to work both around the house and at part-time jobs, there wasn’t a whole lot of guidance when it came to learning how to save or control my spending.

As a result, my own journey to financial peace has been full of giant mistakes and more than a little heartache along the way. I certainly don’t blame my parents—I take full responsibility for my own stupidity—but I can’t help but wonder if I would’ve made better choices had I learned earlier all the things that I know now.

As a result, my own journey to financial peace has been full of giant mistakes and more than a little heartache along the way. I certainly don’t blame my parents—I take full responsibility for my own stupidity—but I can’t help but wonder if I would’ve made better choices had I learned earlier all the things that I know now.

In any case, I am bound and determined to help my kids avoid the mistakes I made. I want them to grow up confident and secure, and to understand exactly how money works and they can make it work for them. It is a tall order—after all, they are only 4 and 7—but I believe in my heart of hearts that it not only can be done, but that it is one of the most important things I will ever teach them.

A couple of weeks ago I received an advance copy of Dave Ramsey and his daughter Rachel Cruze’s new book, Smart Money, Smart Kids: Teaching the Next Generation to Win With Money. I’m already a huge fan of Dave Ramsey’s principles, but this book blew me away. It was SO inspiring! I loved reading about the process of teaching kids about money from both the perspective of a parent and a child who was taught well from the very beginning. While it solidified the conviction I already felt, I also came away with some very practical ideas for exactly how to raise money smart kids. (The book comes out this coming Tuesday, but if you preorder it you will get $50 in freebies, including both a digital and audio copy of the book.)

7 Smart Things to Teach Kids About Money

And while the following list is certainly not all-inclusive, these are the seven things I most want to teach my kids about money:

1. Money Comes From Work

It is pretty scary to realize that most kids these days—and even many parents—don’t understand this very basic concept. Dave and Rachel recommend setting up a commission system—where kids get paid for the work that they do—rather than offering them a weekly allowance. That commission then gets split into 3 separate envelopes—one to spend, one to save, and one to give.

We have set this up in my house, and let me just tell you, it works! The closer it gets to payday, the more enthusiastic my girls become about helping out around the house. They absolutely love filling the check marks in their chore chart, (we use the ones in this Financial Peace Jr. set) then counting up their money at the end of the week. Our payday happens on Sunday night so they have all weekend to boost their payout. Their chores and pay scale are based on their age—7-year-old Maggie has a few harder tasks that can earn more money, while 4-year-old Annie simply earns a quarter per checkmark.

2. When it is Gone, It’s Gone

Teaching kids that actions have consequences is a lesson that goes far beyond money. It is so hard to let your kids fail sometimes! Both my husband and I have a really hard time with this, especially when it comes to money. Rather than letting them make bad choices and then experience the consequence of that choice, we simply say, “no, you can’t buy that,” and all their money stays in the bank. After reading Smart Money, Smart Kids, I realized that we do need to let them experience the process of spending the money that they earn so that they can also learn that when it is gone, it is gone.

3. It’s Okay to Wait

We live in a world of instant gratification, one that is becoming more so all the time, and there are sadly far too many kids who grow up thinking that if they want it, they should have it right now.

A few years ago, as the director of a large day spa, I saw this all too frequently with my entry-level front desk employees, who were mostly girls in their late teens and early 20s who thought working at a spa would be glamorous and easy. I can’t even tell you the number of times one would ask for a raise after just a week—or sometimes even a few days–of work. They had been so accustomed to being rewarded for nothing, they had no concept of delayed gratification. It was sad, and as an employer, extremely frustrating!

Through their commission system, my own girls are slowly learning that it is okay to wait and save for the things they want. Right now they are each saving for a (ridiculously overpriced) Lego play set. $65.00 is a huge number when you are only earning $0.25 at a time, but they are both doing great. Each week they get a little closer to their goals, and each week they become a little more motivated to work harder. I’m pretty sure I will cry the day we finally get to go to Target with their jar full of money to pick out the toy they worked so hard for!

4. It’s Not All About You

Not long ago I was stopped in my tracks by one simple but life-changing question: What are you doing with God’s money? As a Christian, I believe that what I have is not my own. It is a responsibility I take seriously. I am called to be a good steward of the resources I’ve been given, and just importantly, I am called to teach my children to do the same.

But in all honesty, this calling is not a burden. There is no greater joy than teaching my kids how to give! We do this in lots of different ways, especially at Christmas, and our favorite ways to give are with our time, not our money. Even so, it is important that my kids understand that they money they earn needs to be shared.

Each week, at payday, they first put a portion aside to put in their give envelope. They get to decide how much they will give, and they also get to pick the recipient, since at this point we are far less concerned with who they give to than that they experience the joy of giving. I’m sure our giving plan will evolve and adapt as they get older, but it will always be an important part of their financial education.

5. Tell Your Money Where to Go

Right now our primary focus is teaching our kids the basic concept that money comes from work. Even so, by teaching them to divide their money each week into their spend, save, and give envelopes, we are also trying to set the foundation for learning how to budget their money. We want them to learn while they are very young that if you don’t tell your money where to go, it will go away. It is a concept I wish I would have learned much earlier in life!

While the envelope system works great for younger kids, older kids need to be given even more responsibility for their own budgets. By the time they are teenagers, kids should know what their main expenses are–everything from entertainment & activities to clothing, food, and savings–and how to create a simple budget each month to make sure they are living within their means. (There are some fantastic tips for exactly how to set this up in Smart Money, Smart Kids.)

6. Don’t Buy Things You Can’t Afford

In today’s society, our instant gratification mentality has also transferred to our wallets, where we buy things we can’t afford with credit cards so that we can have them right now. Teaching my kids that credit is not the answer means that I have to be willing to live by this philosophy too. After all, if they see me buying whatever I want, regardless of my ability to pay, my warnings not to use a credit card won’t mean a whole lot, especially as they get older. Instead, our goal is to model for them a cash budget system, one where we save for the things we really want just like they do.

As they get older, they will have to learn how to save for bigger things like college or their first car. While car payments and student loans have become the norm, they shouldn’t be. Kids today are graduating from college saddled with huge debts that in many cases could have been avoided with more planning and better choices. We are determined to not let our kids become a statistic by teaching them now that credit is not the answer.

7. Choose Contentment

While all this other stuff is important, helping my kids learn to live with a spirit of contentment is by far the most important lesson I will ever teach them. A wise person once said that there are two ways to be rich—one is to have everything you want, and the other is to be satisfied with what you have.

At our house we call this our “Attitude of Gratitude,” and it is a subject that comes up a lot, especially when my kids start to get whiney or entitled. Last month, for instance, we decided to surprise the girls and two friends with a visit to Disney on Ice, which was touring nearby. As we walked into the arena, they were positively giddy with excitement. Until, of course, they spotted all the light-up wands, cotton candy, stuffed toys, and other assorted trinkets for sale. Their attitudes instantly shifted from excitement to longing. After listening to several rounds of “please, please, pleeeeaaase can we have that Mommy,” we gently encouraged them to list all the things they were experiencing (getting to see princesses, having a fun sleepover with friends, etc.), rather than focusing on things we weren’t buying. It completely changed their perspective, and we all had a great time. (And just in case you are wondering, yes, my husband and I sometimes have to remind each other of this too!)

Choosing contentment is a daily battle and a choice I have to make right alongside my kids. It means choosing to count our blessings rather than focus on what we don’t have. It means remembering to say thank-you, and to stop comparing. And it never, ever ends.

How do you teach your kids about money?

To recap, here are 7 Smart Things to Teach Kids About Money

1. Money Comes From Work

2. When it is Gone, It’s Gone

3. It’s Okay to Wait

4. It’s Not All About You

5. Tell Your Money Where to Go

6. Don’t Buy Things You Can’t Afford

7. Choose Contentment

Other sources on parenting:

- How to Help Your Kids Learn to Do It Scared

- How to Raise Grateful Kids in a Self-Centered World

- How to Teach Your Kids Patience

PIN FOR LATER:

TAKE BACK CONTROL OF YOUR HOME LIFE

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

If you love this resource, be sure to check out our digital library of helpful tools and resources for cleaning faster, taking control of your budget, organizing your schedule, and getting food on the table easier than ever before.

My kids are grown and unfortunately i failed to teach them as much i should have. Winning this kit would be beneficial for them as well as my grandkids.

My daughter Anna is four. I admit, I realized recently, that I did not start teaching her about money and its value early enough. She started saying things like, “just use your card, Mom!” or “do we have a gift card for that?” when I would tell her that we did not have the money to pay for something. She also simply states that “all you need to do is go to a bank, Mommy.” So before I started to teach her about money, I really thought about the values of money and saving; and money and giving; and money and affection. I made a list of what messages I did not want Anna to learn. Some examples: I decided that I never want her to feel any guilt about money or feel that not having something bought for her is tied to her worth. I do not want her to equate gifts to affection. I do not want her to ever be afraid to use money to purchase something she really cares about. I also do not want her to choose security and greed over charity and sharing. Most of the lessons are taught over time–role modeled and practiced. Some lessons will not come until she is more mature in her ability to have abstract thought. But I started teaching her about 3 months ago through play…letting her interact with money and numbers. We play store with her favorite things, which right now are American Girl Dolls, books and Easter eggs. So we use money and math and to problems solve and and make choices all in play. “I have $10.00 today, Ma’am,” she says. And then as the clerk I show her all the options in her ‘bedroom boutique’ of what she can purchase. Using a play credit card is never an option. I have also talked to her about time. Why her Daddy and I go to work everyday. The hours she is with a sitter equal money that we have to buy things. So now she sometimes asks, “How many hours do you have to be away from me at work to buy me this doll?” She has actually stated that me being home more would be way better than getting everything she wants!!! That was a great Mom moment.

My parents were also pretty secretive about money when I was growing up. I definitely want to better prepare my kids, so we have many open discussions about money. We are also trying to teach them to search for bargains, and that it is ok to wear hand me downs or thrift store finds!

My daughter just turned 4, and we gave her a brief talk about $- spend/ save/ give. Now she gets a weekly allowance and we help her sort it into the 3 categories. She’s also done a responsibility chart in the past to teach her about “working,” but honestly I don’t know whether I should tie that in to the allowance or not. I would LOVE to win this for our family!

We too love Dave Ramsey! We just aren’t very good at implementing it, sadly. We just came up with a *new* system for our kids to earn money, and they are starting out very simply with a 10-20-70 rule for tithing, saving & spending. When my older kids earn enough, we will take them to the bank and open accounts for them. We definitely want our kids to manage money better than we do. Thanks for the giveaway, and as always, love your blog! 🙂