What does “financial freedom” mean to you?

To some of us, it means early retirement. To others, it may mean living debt-free or simply not living paycheck-to-paycheck. Financial freedom might mean never worrying in the grocery line, being able to assist your kids with college tuition or even being able to stay at home with your kids rather than working a 9-5.

For many of us, from where we are at right now, those goals might seem so out of reach that we can’t help but think “There’s no way I could ever get there.”

But believe it or not, financial freedom IS possible!

As someone who’s been on both sides of the financial spectrum, I can tell you there are certain steps that worked for me. And trust me–I’m no financial guru. In fact, I struggled with managing my finances, debt and spending for a long time–to the point where it nearly destroyed my marriage. We were in debt. We were living beyond our means. We were fighting about money all the time, and it felt like there was no way out.

But then I started this blog as a way to hold myself accountable and discovered that I had more control than I thought I did. My husband and I went through Dave Ramsey’s Financial Peace University a few years back and it was life-changing for both of us.

Once we realized we longed for financial peace—the freedom from the constant worry about our finances and the belief we’d never have enough—it became attainable. We followed the program and learned a few great tips along the way.

Financial freedom might mean never worrying in the grocery line, being able to assist your kids with college tuition or even being able to stay at home with your kids rather than working a 9-5.Here are the tips and advice we found most helpful on our journey to gain financial freedom.

1. Create an Emergency Fund

If you’re facing debt, it’s scary. Credit cards, lines of credit and small high-interest loans quickly spiral out of control. It’s a natural instinct to want to pay those debts off first.

BUT, if you don’t have savings tucked away, what will happen? The dryer breaks, the dog gets sick, the car transmission goes out, and you’re faced with running up your credit again. Living without savings means debt becomes an endless cycle. You can’t make headway because you’re constantly fighting a losing battle. You’re taking on more water in a sinking ship!

Consider your emergency savings your bucket. You can use it to bail out of a rising tide before it’s too late. You don’t need to continue to take on more debt and repeat the cycle.

For an emergency savings fund, you need about $1000-$2,000 tucked away. Consider an amount that would keep you from drawing on a line of credit or taking out a mini-loan. This doesn’t need to be catastrophic coverage to start (you’ll get there eventually), this is a life preserver in case life goes wrong.

Get more practical tips on how to build that Emergency Fund HERE.

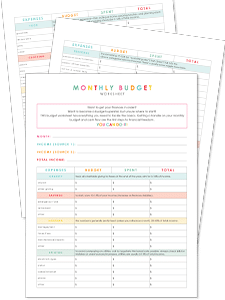

2. Get a Handle on Your Budget

It sounds like a no-brainer, but how many of us work toward paying off our debt and managing finances somewhat aimlessly? Your budget is your clear map from point A to point B. It will show you exactly where you are financially—what’s coming in and what’s going out each month.

Create a budget right in your Living Well Planner® with our comprehensive budget tool built right in. A great budget includes a line item for every expense, bill, and event on the horizon. You’ll need to budget money for your regular fixed expenses (like your mortgage and utilities), and include room in your budget for variable expenses like entertainment and groceries.

Once you start following a regular budget, you’ll identify areas with wiggle room and flexibility. You may also see unexpected trends and patterns. For example, subtle increases in your phone bill over several months (an issue you might not notice if you don’t follow your budget closely).

Creating a budget will also give you the ability to know exactly where you stand financially at a glance. You’ll gain an overview of where your money goes and you’ll identify ways to hold onto more of it.

Now, if you’re cringing at the thought of having to work through a spreadsheet or a budget, know there is still a way for you to manage your finances without one. We’ve broken down how you can still manage your finances if spreadsheets aren’t your thing HERE , while still working through the rest of the steps in this post.

3. Differentiate Needs vs. Wants

This one is tough for so many of us. It’s very challenging to separate out our needs from our wants. After all, do you need new shoes or a café lunch? Probably not, but sometimes it’s a tough call, especially if your shoes are getting worn or you’re on the road and hungry.

Many of us have the majority of what we need. We have food, shelter, transportation, clothing, as well as access to education, healthcare, and protection. When we look at our basic needs, they’re covered. In fact, most of us have MORE than what we need.

At the same time, most of us work very hard. We want to provide a warm, beautiful, inviting home for our family. We want to create enjoyable meals and have fun with our families. We want to enjoy life!

Achieving financial freedom allows us to enjoy life without the worry and guilt. When we’re financially free we feel secure. We have enough. We can even use what we have to help others. Achieving financial freedom requires a strong will. We must keep our eye on the prize and not succumb to fleeting wants.

Determine what you really need versus the items you would like, but don’t need right now. Take a step back to look at it from a higher perspective. Can this purchase wait? Will you get the opportunity to enjoy this purchase again in the future? Is this a purchase you need right now or is it simply an item you want?

4. Find Ways to Make Saving Simple

I don’t know about you, but I have a tough time parting with cash. Swiping a debit card? That’s easy—it’s money I’ve never even seen. The same goes for a credit card. Letting go of cold hard cash, though? That’s a lot tougher.

If you’re the same way, consider budgeting out your money in cash amounts. You may want to use an envelope system where you earmark your money for each expense. This requires trial and error. It may be easier to pay certain bills online or with automatic withdrawal, and others using paper money or writing checks.

Set up an automatic transfer to move money to savings on payday. You never need to touch the money or deliberate over tucking it away or going out to dinner. The money will already be taken out of your account.

Check with your bank to see if they offer other savings vehicles and accounts. Certain banks allow you to “round-up” purchases and transfer the change to your savings account. Other banks provide accounts with higher interest rates or lower fees if you keep withdrawals to a minimum. The idea is to simplify and automate saving money whenever possible. Every little bit adds up.

5. Downsize

During your journey to financial freedom, you may experience several realizations. For me, a big realization was that we were living beyond our means in certain areas.

Scaling back is a challenge. It’s hard to consider living with less. Could you and your family skip your vacation this year? Could you enjoy a simpler Christmas? Could you let go of a TV or app subscription for a while?

Bigger downsizing questions get even more challenging, like considering going back to a cheaper car (or public transportation). It’s even tougher to think of moving into a smaller home or taking on a second job.

Downsizing is similar to dieting. No one wants to think of forgoing treats, skipping dessert or working out all the time. But then you do it and start to see results. You realize this won’t be the last time you ever enjoy a piece of chocolate cake or a bowl of ice cream, but it’s worth passing up for now. Think of downsizing your spending as the same concept: putting yourself on a financial diet.

6. Find Additional Income Streams

If you’ve looked at your budget carefully, worked on an emergency fund and started to pay down your debt, you may still feel like you can’t make ends meet. This is tough, especially if you’ve got a lot of debt to pay off.

Sometimes the answer is to find additional ways to earn money. It doesn’t necessarily mean you need to run out and get a part-time job (although that’s one good and immediate solution). You can also consider ways to earn money from home. You could watch a friend’s children a few days a week, take on neighborhood jobs or teach lessons, or even sell items you already own.

There are also many ways to earn money online by doing jobs like proofreading, virtual assisting, and starting a blog or online business. This is something I’ve been teaching at Elite Blog Academy® since 2014, and in the past five years, I’ve helped nearly 10,000 students in 60 countries worldwide create successful, profitable online businesses of their own. (Public registration for EBA® only opens once a year, but if this is something you are interested in, you can join our waiting list HERE.)

Regardless of HOW you decide to supplement your income, the little boost of additional money is often what you need to get over the savings hump. Once you’ve tucked away an emergency fund, use extra money toward paying down your debt. Start with your smallest debt first until it’s paid off completely. Then put the additional money toward your next smallest debt and build from there. This is called the debt snowball method—it’s motivating and fast!

7. Be Patient, but Diligent

Financial freedom is a long-term goal, but it’s a very worthy one.

Remember, your debt didn’t build up overnight. You didn’t veer into financial chaos in a day. It will take time to undo, but if you’re diligent and dedicated to your cause it will happen. Sometimes when goals seem to take a long time to achieve we might become frustrated or start to consider giving up.

Don’t throw in the towel because it’s a slow process. As you’re building up your savings and paying down your debt, you need to keep your eye on the big picture. Think of what financial freedom means to your family. You may even want to create a vision board or go to Pinterest and find inspirational images of what financial freedom looks like to you.

Imagine how great it will feel when you don’t have to worry about bill collectors anymore. Picture how relaxed you’ll feel when you know your future is secure and you don’t worry about unexpected events derailing your progress.

Financial freedom is a long-term goal, but it’s a very worthy one. Of course, we all feel like giving up from time to time. Let’s face it, in the moment taking on debt for instant gratification is easy and saving money is hard. Keep your eye on the prize. Remember WHY you want this.

If you experience a setback, pick yourself up, dust yourself off and start over. Setbacks and mistakes happen, but don’t use them as a reason to quit. Use them as a lesson to learn and a chance to become even stronger!

8. Put Checks and Balances in Place

SMART goals work because they’re measurable. You can see your progress and you know you’re crushing your goals as you move along. Set up metrics and accountability with your financial goals to track your path. Use our beautifully detailed Goal Crushing Worksheet to map it all out and get the ball rolling.

Ask a friend, a spouse or someone in your family to touch base and to hold you accountable as you move toward your goal. If you feel you need to give yourself tough love (and avoid temptation), ask them to hold on to your debit or credit card.

You can reduce your spending limits on your credit cards and even lower your allowed spending amount per day.

If you’re cutting back on a specific spending area (like going out to eat), set a realistic goal for yourself, such as limiting restaurant dinners to once or twice a month. Alternatively, use cash or purchase gift cards for line items in your budget. You’ll be held to keeping your spending within a preset limit. Bring only what you’re allowed to spend when you go to the store.

Implementing spending roadblocks helps us resist the urge to spend when we’re feeling vulnerable or struggling to hold to our budget. Keep yourself accountable and measure your success!

Financial freedom is well worth the effort. Knowing you have enough to live the life you want, give to others and care for your family is incredibly satisfying. While money certainly can’t bring us happiness, worry, and stress about finances will push us into an unhappy state.

Move toward financial freedom and peace. It may take time and hard work to get there, but once financial freedom is achieved, it’s worth the sacrifice. You’ll rest assured knowing your biggest financial worries are resolved.

TAKE BACK CONTROL OF YOUR HOME LIFE

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

If you love this resource, be sure to check out our digital library of helpful tools and resources for cleaning faster, taking control of your budget, organizing your schedule, and getting food on the table easier than ever before.

Ohh, I also had some problems with money last year…But now it is ok. I earn a profit from sports betting. There are two main ways: arbitrage and prediction betting. I know people which have sport betting as a main job. As for me I make bets on tennis via Totesport(https://www.bookmakeradvisor.com/uk/review/totesport/) and some times play online poker.

A lot of people are really stressed out because of their student loans and the whole situation is just ridiculous. The education is useless because it doesn’t give you much. And it’s not a surprise, all those countless essays are really useless. At least any student can spend some time reading essay service reviews and start using one to save tons of time.