This is a guest post from Kalyn Brooke of KalynBrooke.com

Whether you’re amazingly frugal or just starting out on your journey toward financial freedom, there’s probably one area most of us still struggle in — impulse spending.

Recently, I had the opportunity to learn how not to impulse spend from one of my not-so proud-impulse moments. My husband and I made a huge TV purchase that I knew we shouldn’t have bought, but I happily went along with it anyway because my emotions completely overpowered the practical side that is usually in control.

If you know me at all, this was very much out of character for my personality! Yet for that split-second moment, I just couldn’t resist the draw of my wants over actual needs.

Does that sort of thing happen to you too?

Overcoming that desire for more is hard, especially when you stumble upon an irresistible deal, or a friend’s recent purchase creates all sorts of green-eyed feelings inside. But if there’s one thing I’ve learned, it is totally possible to keep those yucky emotions under control.

These 5 action steps will not only create a healthy attitude toward spending in general, they will also help curb those impulse spending habits for good.

1. Wait Before You Buy

Did you know you can prevent almost any impulse purchase just by waiting a full 24 hours before finishing the transaction?

This idea of waiting gives our brain a psychological boost that convinces us we don’t need an item as much as we think we do — and we can totally work this to our favor.

For example, I am notorious for shopping online and transferring items to my cart, then waiting to see if I really need to buy them or if I’m just having an emotional shopping spree. After 24 hours, I almost always forget that I was going to purchase something, and by the time I do remember, the sale is often long-gone or the item isn’t even available anymore!

2. Avoid Tempting Situations

Much of the desire to impulsively spend stems from a situation that tests our limits of self-control, but this can be avoided just by putting a few extra rules and checkpoints into place.

Here are some ideas:

- Unsubscribe from all deal related emails and store subscriptions – If just seeing a good deal, coupon, or sale is enough to make you spend, get those emails out of your inbox! You will feel so much more freedom and control knowing that you aren’t tied to those weekly alerts.

- Stay offline – Give yourself some time to unplug from technology. Advertisers are all over social media and website offering services and wares for “one low price”, and you can avoid these entirely by putting limits on your screen time.

- Stay home – The more I stay home, the more I stay out of stores, and the more I stay out of stores, the less I spend. Makes sense, doesn’t it? Plan your errands for just one day a week, and commit to keeping your schedule free so you aren’t out and about fighting the temptation to pop in somewhere just to see what’s hanging on the clearance rack.

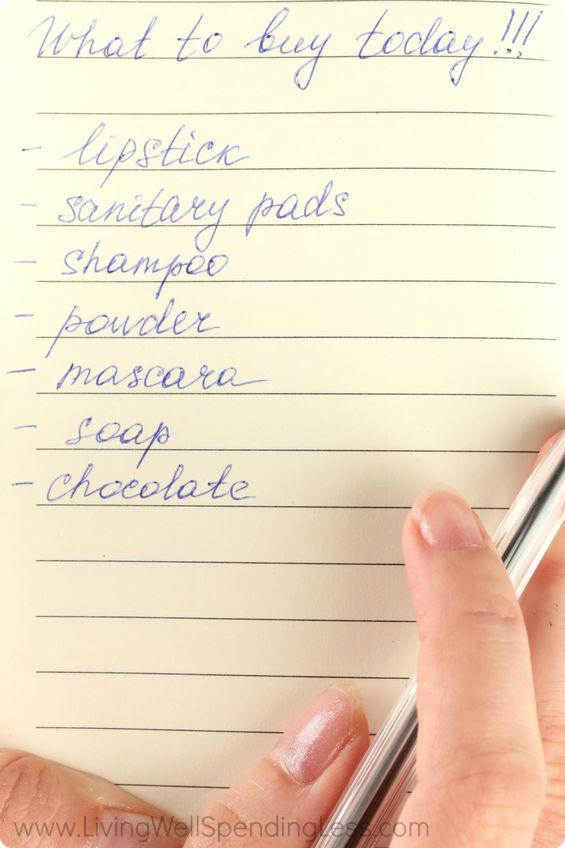

3. Plan Ahead with Lists

Most impulse purchases can be prevented with a battle plan, aka sticking to a list. I know I personally throw way more things in my cart when I forget that list at home. I want to make sure I don’t have to make another trip, but as a result, I almost always go over our grocery budget for the week!

But it’s not just grocery lists we need to be keeping — I would encourage you to start some personal and family Wish Lists too. These can be anything from birthday gifts, home improvement ideas, furniture, and/or appliances that you would love to have.

Start a separate savings column or cash envelope for each of these items, then purchase things on your list according to priority. If a great deal or sale pops up, you can either purchase it with the money you’ve saved up, or store the link for later when you do have that money. Because spending isn’t bad in itself….we just have to be intentional about doing it!

4. Give Yourself Fun Money

Likewise, start a fund for you and your spouse to set aside “no strings attached” kind of cash, or Fun Money. It might just be $5-$10 per paycheck to start, but having a little bit of income that you don’t have to be accountable for can give you the extra high that normally accompanies impulse spending.

My husband chooses to spend his on take-out and soda, whereas I prefer to add to my book collection. The key is we’ve already planned ahead for these types of purchases, and when the money is gone, it’s gone.

5. Develop Contentment

Lastly, if we dive right into the root of impulse spending, I honestly believe it has to do with our level of contentment. No matter what your financial situation looks like right now, you and I probably have it pretty good compared to much of the world.

It has been proven over and over again that more possessions does not equal happiness, and if there is one thing I want you to take away from this post, it is this: Satisfaction comes in being thankful for what we have, not what we can get.

Tight grocery budgets and small incomes hurt — I’m not downplaying that, but enjoying those precious family and friends around us, and taking stock in the unexpected blessings will ultimately be what curbs that desire for more. If this is something you really struggle with (and don’t we all?) these seven ways to be more content can help a LOT!

So next time an unused coupon gives you anxiety, or a red clearance sticker starts calling your name, remember you control your spending, not the other way around. Spot your weakness, then create an action plan to control it.

You can do this!

Kalyn Brooke is a life management expert for busy women

who crave a simpler and more organized life. Through her recognizable, down-to-earth approach, she provides a daily dose of inspiration and guidance, whether you’re looking for smart money tips, time saving routines, or anything in-between. When she’s not experimenting with ways to do even the most mundane tasks more efficiently, you can find her crafting detailed to-do lists in her bullet journal, or indulging in—yet another—personal development book. Meet Kalyn and learn how stay on top of it all at KalynBrooke.com.

TAKE BACK CONTROL OF YOUR HOME LIFE

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

Ever feel like you just can't keep up? Our Living Well Starter Guide will show you how to start streamlining your life in just 3 simple steps. It's a game changer--get it free for a limited time!

If you love this resource, be sure to check out our digital library of helpful tools and resources for cleaning faster, taking control of your budget, organizing your schedule, and getting food on the table easier than ever before.

My only problem is I am tight fisted and Ido pay bills and done with but by the end of the mouth when most spend all. Well not in my case.